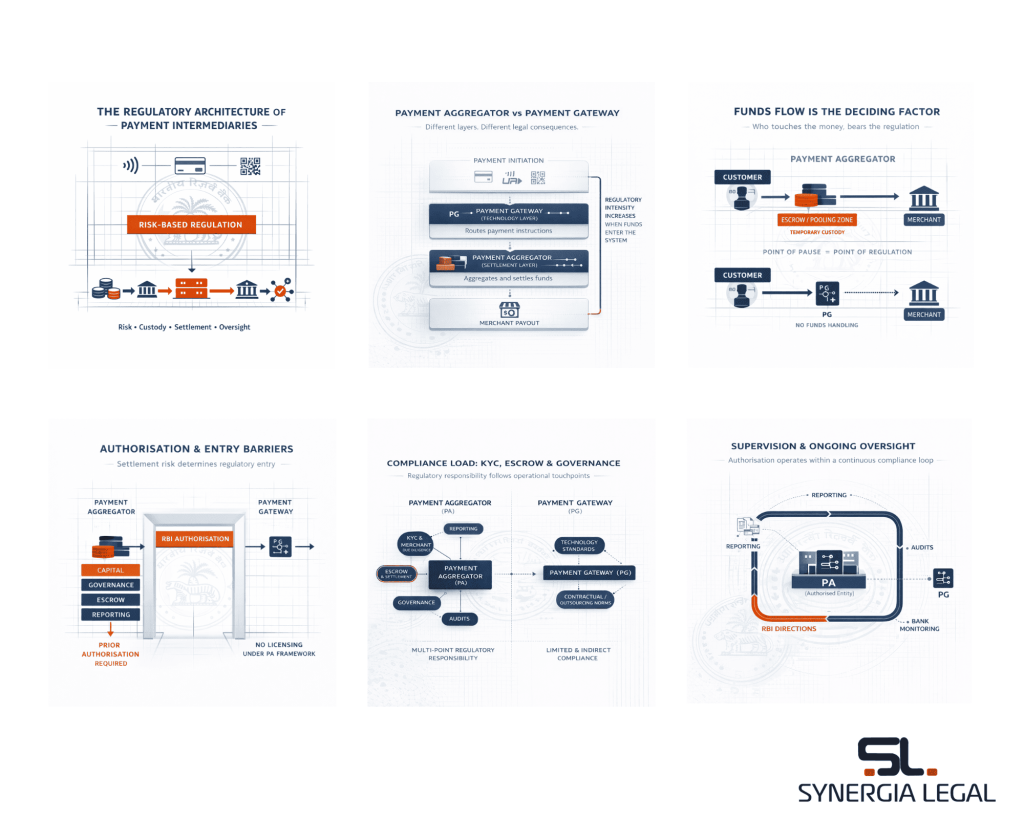

Payment Aggregators and Payment Gateways in India: Understanding the Regulatory Divide

India’s digital payments ecosystem has evolved from a facilitator-led model to a systemically important financial infrastructure. As transaction volumes scale and intermediaries increasingly sit between payers and merchants, the regulatory lens has decisively shifted from technology enablement to funds custody and settlement risk. This shift is most visible in the regulatory treatment of “Payment Aggregators” […]

Payment Aggregators and Payment Gateways in India: Understanding the Regulatory Divide Read More »